Mastering Japan’s Year-end Tax Adjustment

The concept of year-end tax adjustments is the same across the world; however, the processes may vary. As a foreigner working in Japan, it’s crucial to understand the Japanese tax rules, including the year-end tax adjustment (Nenmatsu Chosei).

What is Nenmatsu Chosei?

Nenmatsu Chosei (年末調整 or ねんまつちょうせい) is the annual tax adjustment process in Japan. This tax adjustment for the previous year must be completed by the 31st of January each year. As an employee, there’s no requirement for you to personally handle this since it’s your employer’s responsibility to take care of it.

Filing the year-end tax adjustment affects how much tax you have to pay and is also a mandatory legal requirement. Therefore, it’s crucial to understand the process and how they apply to you when filing your year-end tax returns in Japan.

Tax Rules and Filing Tax Returns in Japan

Tax rules and the year-end tax adjustment in Japan can differ from your home country. However, whether you’re an expat or a Japanese citizen, the tax rules can vary based on where you live, your job, how you earn money, and your situation.

The process of making the year-end tax adjustment as an expat in Japan can be a bit tricky, but don’t worry! In this article, I will help you understand how taxes work in Japan for foreigners.

While it’s crucial to know your tax responsibilities in Japan, you should also talk to a tax expert or get advice from local tax authorities to calculate your income correctly and follow Japanese tax rules.

As mentioned above, you don’t have to do the year-end tax adjustment paperwork yourself as an employee. Your employer should take care of it for you and submit it by January 31st of next year. However, you’ll need to give your employer the necessary information so they can figure out how much tax you owe.

Moreover, there are some situations where you might not have to do this year-end tax adjustment in Japan. However, we’ll explain those in this article, too.

Are you ready? Let’s dive into all you need to know about year-end tax adjustments in Japan!

What is the Japanese Year-End Tax Adjustment?

Like many other countries, Japan has a system where your employer deducts money from your monthly salary for taxes. This deduction is known as TDS or Tax Deduction at Source. This helps the government collect taxes easily and ensures people don’t try to avoid paying their taxes. It also gives the government a steady stream of money throughout the year.

Now, the year-end tax adjustment is when they check how much money you should have paid in taxes for the whole year. This overall tax liability is then compared to what your employer already deducted from your salary.

If your employer has deducted more money than you owe in taxes, you’ll get a tax refund at the year-end. But if they didn’t take enough and you owe more taxes, you’ll have to pay the extra amount.

(Note: You can use our online net salary calculator to calculate your income tax and net pay)

How Does the Japanese Year-End Tax Adjustment Work?

You might be thinking, “If they take taxes out of my paycheck every month, why do I sometimes owe more money at the end of the year?”

Well, the reason is that the amount taken from your monthly salary is just an estimate. They calculate it at the start of the year based on your income and other things. This estimate might not be accurate anymore if anything changes during the year. These changes may involve getting a new job, salary revisions, any additional income, or changes in the number of dependents.

For example, let’s say your spouse lost their job during the year, or your child moved out and started making money. The government can’t keep track of all these changes, so they need to adjust the calculations at the year-end. This tax adjustment is necessary to ensure you pay the right amount of tax.

These adjustments consider all the changes during the year and compare them to what was estimated. This process can result in either getting some money back if you paid too much or having to pay more if you didn’t pay enough.

As an expat in Japan, your tax situation might differ from that of Japanese citizens. Therefore, it’s essential to understand how your taxes work.

Japanese Tax Regulations for Expats Working in Japan

Certain tax rules apply specifically to foreigners who work in Japan, but they are not the same as those for Japanese citizens. Here are some important differences:

Residency Status

Foreigners in Japan can have different residency statuses like “Permanent Resident,” “Long-Term Resident,” or “Temporary Resident.” How taxes are handled depends on your residency status. Temporary residents usually only pay taxes on the money they earn in Japan.

Withholding Taxes

Employers must take out income tax from the salaries of foreign workers. The amount taken out depends on your residency status and other things.

Tax Treaties

Foreigners may benefit from agreements between Japan and their home countries. These agreements can affect how different types of income, like your salary and dividends, are taxed.

Reporting Overseas Assets

Some people living in Japan, including foreigners with long-term status, might have to inform the government about their assets and income in other countries if they go over certain limits. This doesn’t apply to all foreign residents and depends on the tax treaties for concerned countries.

Filing Deadlines

Usually, Japanese citizens and foreign residents in Japan must file their taxes around March or April of the next year. However, depending on your situation, expats in Japan might have different deadlines.

Special Taxes for Non-Residents

Some foreigners who don’t live in Japan permanently might have to pay a fixed tax rate on certain income types. For example, these income sources include money from renting out property in Japan.

Tax Exemptions

Some foreign residents might qualify for tax breaks or lower taxes for a specific time, especially if they have a special visa, like the Highly Skilled Professional (HSP) visa.

It’s a good idea to talk to a tax expert or ask the local tax authorities if you’re unsure which rules apply to you. They can help you determine if any special agreements, tax rules, exemptions, or different tax deadlines relate to your situation.

Does the Japanese Year-End Tax Adjustment Apply to Expats in Japan too?

In a nutshell, yes. The year-end tax adjustment in Japan applies to anyone who has a job and lives in Japan. However, there are some cases where you might not have to do it. Keep reading to see if you qualify for any exemptions.

Are there any exemptions for expats in Japan for the year-end tax adjustment?

You might not have to deal with the year-end tax adjustment rules if you fall into the following categories: instead, you will have to file for kakutei shinkoku (final income tax return) in such cases:

1. Self-employed or a Freelancer

If you are self-employed or freelancing in Japan, the Nenmatsu Chosei or year-end tax adjustment does not apply to you. Instead, you’ll need to file a Kakutei Shinkoku (確定申告). The Kakutei Shinkoku is a final income tax return, which we’ll discuss later in this article. Skip to Kakutei Shinkoku.

2. Directly employed by an overseas company.

You won’t have to worry about the year-end tax adjustment if you work for a foreign company that does not have a Japanese entity. If you work for the Japanese branch of a foreign company, it’s seen as a Japanese company for tax purposes, and you’ll have to do the year-end tax adjustment.

3. Working for a domestic company that is not the Japanese branch of an overseas company

In this situation, a “domestic company” means a company that is set up and mostly does business only in Japan, serving Japanese customers or mainly working within the country.

If you work for a company like this in Japan, not for a foreign company’s branch in Japan, you might get to use an easier way to report your taxes. This makes things simpler for people whose finances are not too complicated. It helps both taxpayers and the tax people by reducing the paperwork and hassle.

4. Employed by multiple companies or have side jobs

If you make money from different places, like having more than one job or doing side gigs, there are times when you don’t have to do the year-end tax adjustment. Here are some situations:

4(a). Multiple Income Streams

Sometimes, you get money from different places, and each of them might have their tax stuff to deal with.

4(b). Regular Year-End Tax Adjustment

Usually, you have to check if the total money you made in the year and the taxes you owe match what was deducted from your main job throughout the year.

5. Low Income

If you don’t make much money, like less than 200,000 JPY a year in Japan, you might not have to do the year-end tax adjustment. This is for people with smaller incomes or those working part-time with their main job.

6. Special Income

Some types of money, like certain bonuses or allowances, might have different tax rules. If that’s the case, you might not need to do the year-end tax adjustment.

Remember to ensure you’re following the tax rules. If you’re unsure if you need to do the year-end tax adjustment in Japan, it’s a good idea to talk to tax experts or ask the tax people for guidance.

7. Leaving Japan before the end of the year after working with a Japanese company

If you quit or leave a Japanese job before the end of the tax year (usually March 31st) and don’t make money from other things in Japan that year, you might not have to make the year-end tax adjustment.

Your previous employer should give you a special tax paper called a Gensen Choshu Hyo (源泉徴収票). This tax paper shows how much you earned and how much tax they took out up to the day you left.

You might need to tell the tax office that you quit the job. The tax office will then figure out how much tax you owe based on what you made while you were in Japan.

They will make the necessary tax adjustments depending on when you quit and how much you made. In such a case, you could get some extra tax money back if you already paid more taxes or have to pay more if they didn’t take enough.

Keeping good records of your money, taxes, and when you left is critical. This helps when you talk to the tax people.

If you’re leaving Japan for good, you should get a Nouzei Shomeisho (納税証明書), or tax clearance certificate, from the tax office. It says you have paid all your taxes, and it can be helpful for things like visas and where you live.

8. Earning over 20 million JPY annually

If you make over 20 million JPY a year in Japan, you might get to do a more straightforward way of filing your taxes. This makes things easier and less complicated than the usual year-end tax adjustment.

With this simpler way, you don’t have to give as much detailed information about your earnings, like where it comes from and what you can deduct, as people who do the regular tax adjustment. This helps if your money matters are not too complicated. But remember, you still need to keep good records of your earnings and spending, just in case the tax people want to see them.

If you make more than 20 million JPY, you can also find ways to lower your taxes legally. Tax experts can help you figure out how to pay less.

However, here’s the thing: Even with this easier way, if you don’t do your taxes right, you can still get into trouble and have to pay penalties and extra money. So, it’s crucial to make sure your tax report is accurate and complete.

So, if you don’t have to do the regular Japanese year-end tax adjustment, you’ll have to do something called Kakutei Shinkoku (確定申告) or Final Income Tax Return. Let’s talk about that next.

Final Income Tax Return (Kakutei Shinkoku)

If you don’t have to do the usual year-end tax adjustment in Japan, you’ll need to do something called a final income tax return or a Kakutei Shinkoku (確定申告). You can usually do this between February 16th and March 15th every year.

You can file your tax return at your local tax office or online through the official electronic filing portal of the Japanese National Tax Agency here: E-Tax. They also have a helpful guide in English.

Another online tax payment system approved by the Japanese government is eL-Tax. However, please note that this portal does not have English support.

Blue or White Kakutei Shinkoku?

There are two ways to file your Kakutei Shinkoku, which depend on the tax deductions that best apply to you. There’s the blue tax return, or Aorio Shinkoku (青色申告) or the white tax return, or Hakushoku Shinkoku (白色申告). The tax rates for white tax return filers are the same as those for blue tax return filers and are determined by income level.

Blue Tax Return (Aorio Shinkoku)

The tax rates for blue tax returns are generally the same as those for white tax returns, but the reporting process is simpler. The blue tax return is designed for individuals and sole proprietors with relatively simple financial transactions.

It offers reduced administrative burdens and typically requires less detailed documentation and record-keeping. While the blue tax return may provide certain deductions and credits, its scope may be more limited than that of white tax returns.

The filing deadline for the blue tax return is normally later than that for the white tax return. However, the specific deadline may vary depending on your circumstances and the particular jurisdiction of your local tax office.

White Tax Return (Hakushoku Shinkoku):

Everyone who pays taxes in Japan can use the white tax return. It’s the regular income tax form for all sorts of people and businesses, like individuals, workers, self-employed folks, and companies with more complicated finances.

If you have different ways of making money, like more than one job, investments, renting out property, and many things to take away from your income, this form is for you. People who use the white form can get more deductions, credits, and things to reduce their taxes.

With the white form, you have to give detailed information. This info includes where all your earnings come from, any special tax deductions, etc. Unlike the blue tax form, there’s no limit on how much money you need to make to use the white one.

However, you must turn in your white tax form earlier than the blue one, usually around March or April next year.

If you have any doubts about which tax return to choose, it is crucial to consult with tax authorities or professionals.

What Do I Need to Declare for My Year-End Tax Adjustment?

To prepare for your annual year-end tax adjustment, your employer will give you several forms that must be filled out around November or December each year. These separate forms will ask for any personal information that needs to be updated for the year.

These tax forms will include details about your dependents, property loans, and insurance premiums. The insurance premiums include life insurance, health insurance in Japan, earthquake insurance, etc. These details help calculate any exemptions you may be entitled to. These exemptions will affect the amount of your year-end tax adjustment.

Forms to Fill Before the Year-end Tax Adjustment

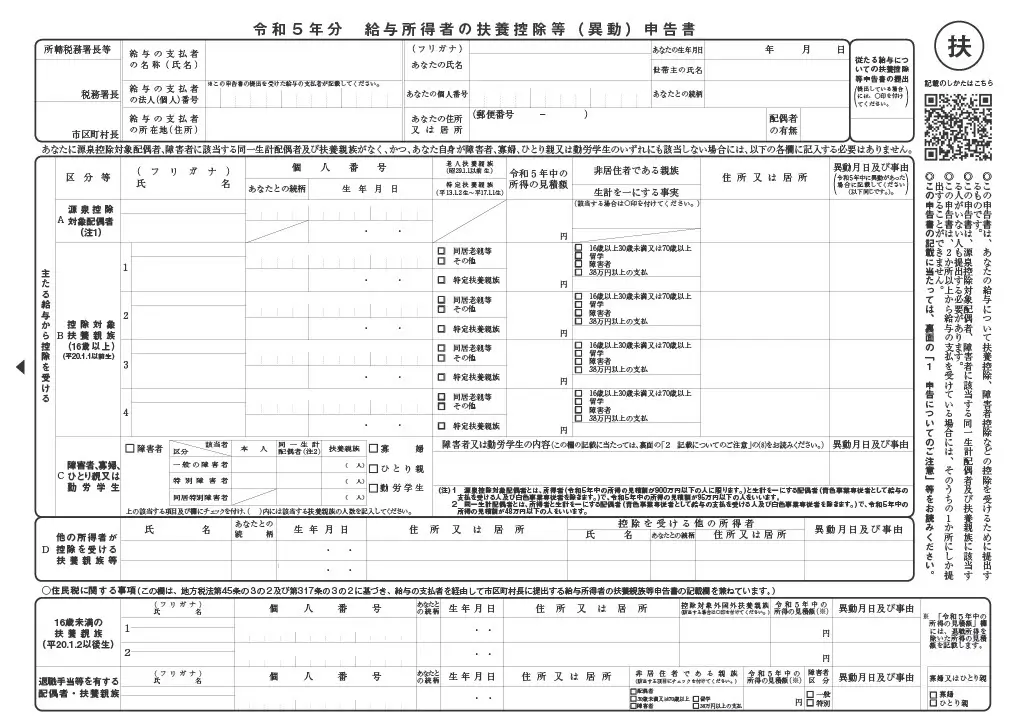

You need to fill out the following three forms before filling out the year-end adjustment form or Nenmatsu Chosei (ねんまつちょうせい):

- Dependent deduction, etc. (change) declaration form

- Spousal deduction, etc. declaration form

- Insurance premium deduction declaration form

Tax Deduction Form for Dependents

The dependent deduction form (令和5年分 扶養控除等(異動)申告書【入力用) is to declare family members who are dependent on you. You must fill out this form every year in Japan because the number of dependents may change.

Please note that you can avail of income tax deductions for each of your dependents, even if they are not in Japan. However, there is a catch there. You must provide proof of bank remittance to your dependents who are overseas.

However, income tax authorities do not go into the micro details to check every remittance. You just need to attach the bank slips for a couple of bank transfers during the concerned financial year.

Here is what the form for income tax deduction for the dependents looks like:

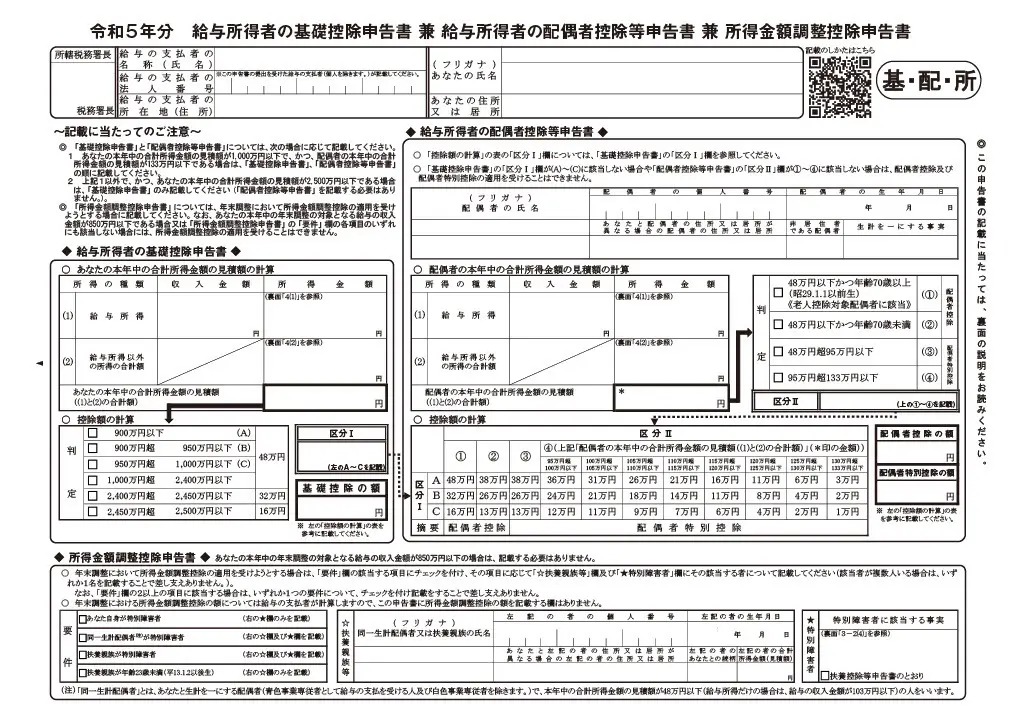

Form for Tax Deduction with Spousal Deduction

If your spouse in Japan is not working, then she is 100% dependent on yours. In such a case, the form for the tax deduction for your dependents would take care of your tax adjustment for your spouse.

However, what if your spouse is also working and earning in Japan? For taxpayers earning under JPY 10 million, a spouse exemption is available for a non-dependent spouse. This exemption reaches up to JPY 380,000 for national income tax and JPY 330,000 for local inhabitant’s tax, depending on the spouse’s income level.

You can get the standard spousal tax benefit to get your income tax adjusted by filling out the following form:

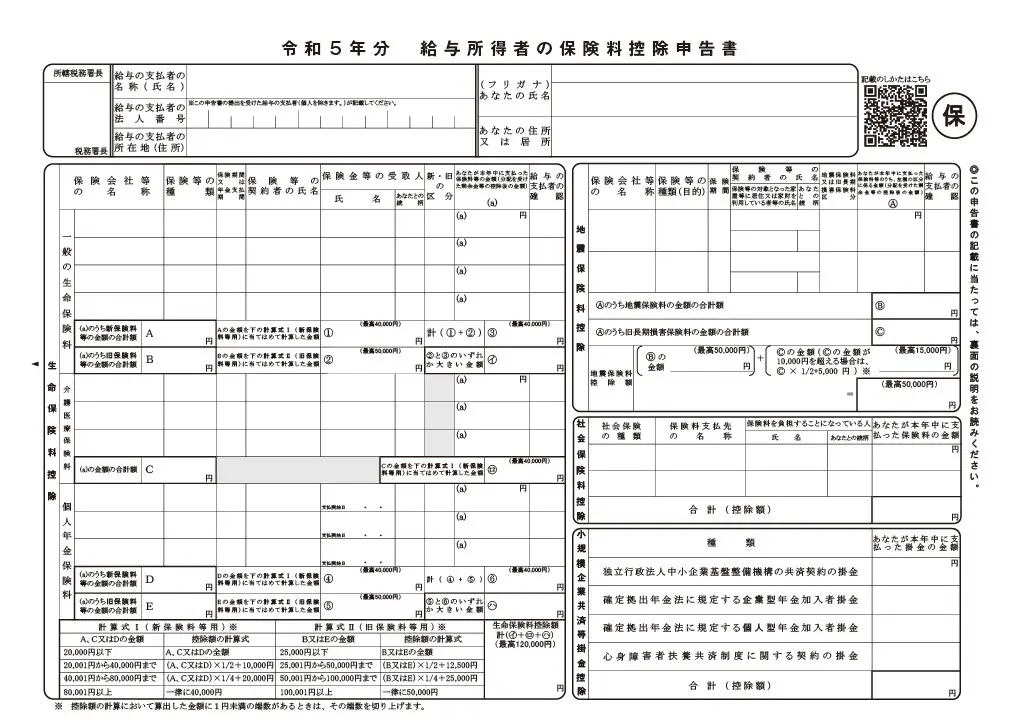

Year-end Tax Adjustment for Japanese Insurance Premiums

Yes. Like most countries, Japan also deducts income tax on the insurance premiums you pay for genuine insurance. When I say “Genuine,” I mean that you must not expect to get an income tax benefit for insurance on artwork, pets, and other such items.

Here is what the Japanese year-end tax adjustment form for declaring your insurance premiums look like:

Try to fill in all your information as accurately as possible. Moreover, seek help from a professional tax specialist or someone in your company if you need help.

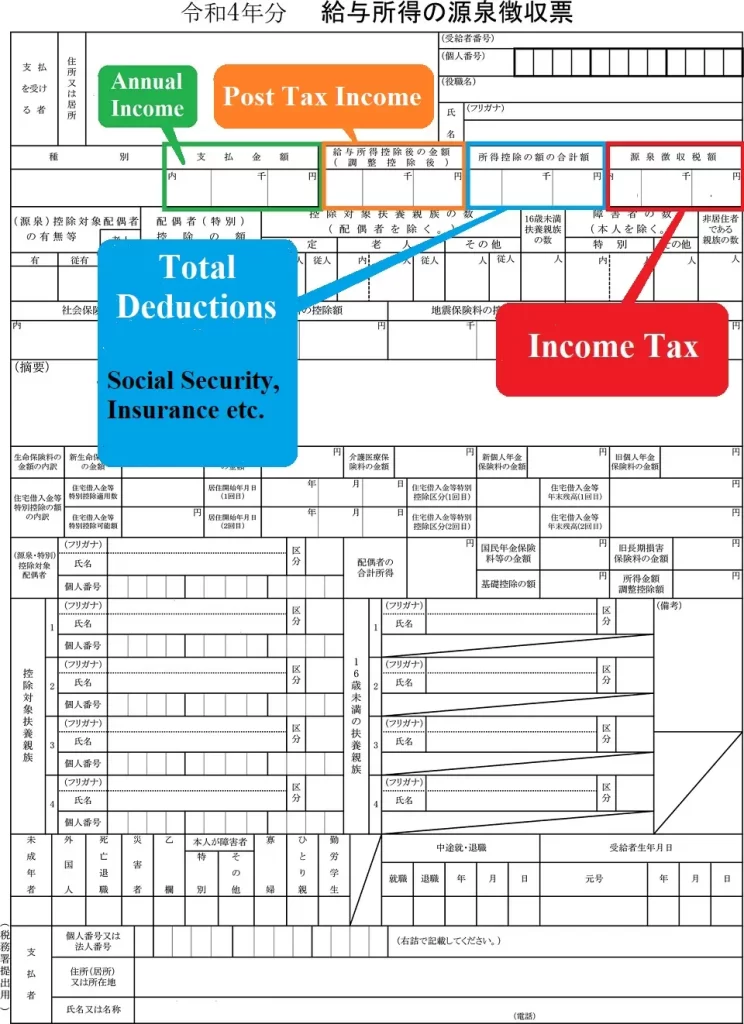

Your employer will also give you a document called the Withholding Tax Statement, or Gensen Choshuhyo (源泉徴収票). It shows how much money you were paid that year and how much tax your employer deducted. Let’s check out this document:

Sections of the Japanese Withholding Tax Statement

This important document will have four sections with details that you must check and confirm that the information is correct. Let’s go through the statement and find out what these sections are:

1. Shiharai Kingaku

Shiharai Kingaku (支払金額) means “amount paid”, i.e., the total amount that your employer has paid you throughout that year, including any overtime and bonuses.

2. Kyūyo Shotoku Kōjo-go no Kingaku

Kyūyo Shotoku Kōjo-go no Kingaku (給与所得控除後の金額) means “amount after employment income reduction”, which is the amount of your salary after deduction of any taxes.

3. Shotoku Kōjo no Gaku no Gōkei-gaku

Shotoku Kōjo no Gaku no Gōkei-gaku (所得控除の額の合計額) refers to the total amount of your salary that was deducted, according to tax rates as set by the Japanese National Tax Agency

4. Genzenchōshū Zeigaku

Genzenchōshū Zeigaku ( 源泉徴収税額) means “withholding tax amount”, which refers to the total amount of tax that was deducted from your salary throughout the year, and this is the amount that is important for you to calculate your year-end tax adjustment from.

An Important Final Note About Your Year-End Tax Adjustment Form

If you leave your job or switch jobs in Japan, remember to keep your Withholding Tax Statement from your previous employer. You’ll need this when you apply to a new company. Your new employer will need it for your tax adjustment at the end of the tax year. This form shows how much money you earned in your old job.

In Japan, especially at traditional companies, they might ask you about your old salary during job interviews. You have two choices: politely say no and keep it private, or tell them the truth. Even if you don’t inform them, they might still find out your old salary by looking at your tax statement. Therefore, it’s better to be honest.

Another way to avoid this question is to do your tax returns. As mentioned, you can do this at your local tax office or online. So, as you can see, handling your taxes as an expat in Japan is pretty simple. However, to simplify it, you must understand the process and keep good records of your income and any expenses or special things that might reduce your taxes.

A bilingual native Japanese, Naoko accumulated 14 years of experience in multinational companies’ diverse fields like HR, accounting, and sales support after graduating from the State University of New York. She is a co-founder of ReachExt K.K. and EJable.com.